Take a step back and look towards the future now that a frustrating election cycle has ended. We have been in a media lockdown where everything from your morning commute to retirement portfolio has been politicized. Let me explain the real long-term effects of what just happened.

It’s hard to tell our clients that sometimes their feelings don’t influence market returns over time. See how I said “sometimes”? On the short term if enough people freak out about a non-issue, it can put a market on sale or create a bidding war for less and less gain.

What Really Determines Stock Prices

Stock returns are determined by two variables: dividends and capital appreciation. Capital appreciation is determined by earnings, growth, and the change in the price earnings multiple. In plain English, is the company growing and making more money and do investors love it or hate it more?

We simply don’t have enough data to identify a systematic pattern in election years. On top of that, market returns have mostly been positive in election and subsequent years. And unless you have been living under a rock this year, market expectations have been baked into the current price of stocks and bonds.

Show Me The Money

Average returns for presidential terms since 1929 have been 10.1%. Wait a second, if politicians are so bad then how can the stock market go up after all these years? You know why. Because stocks make money based on selling things to people. Public companies evolve and change to the current political and regulatory environments. It can be easier or harder to make a buck in America, but we seem to be doing okay.

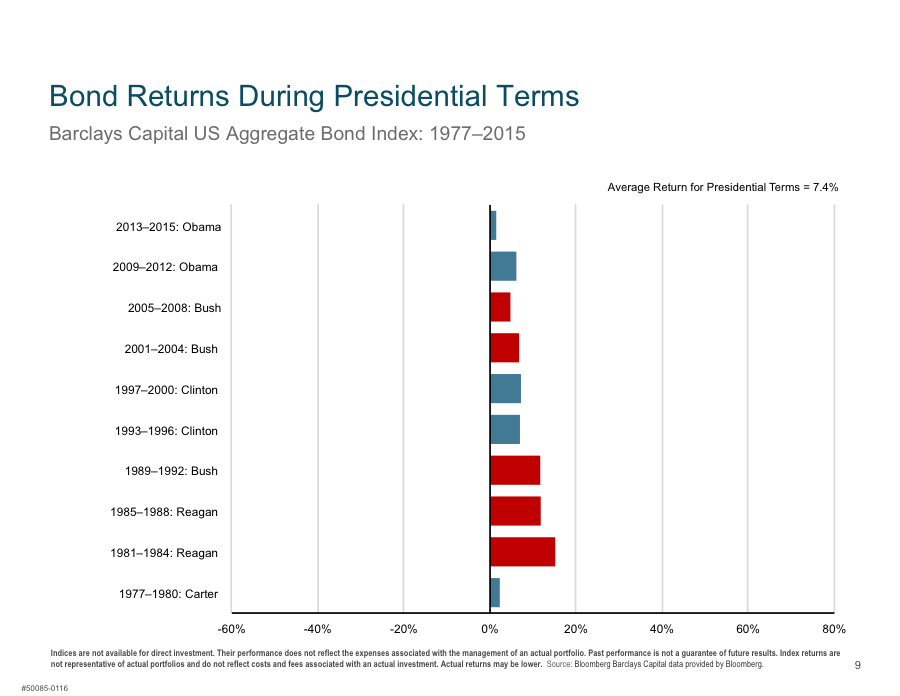

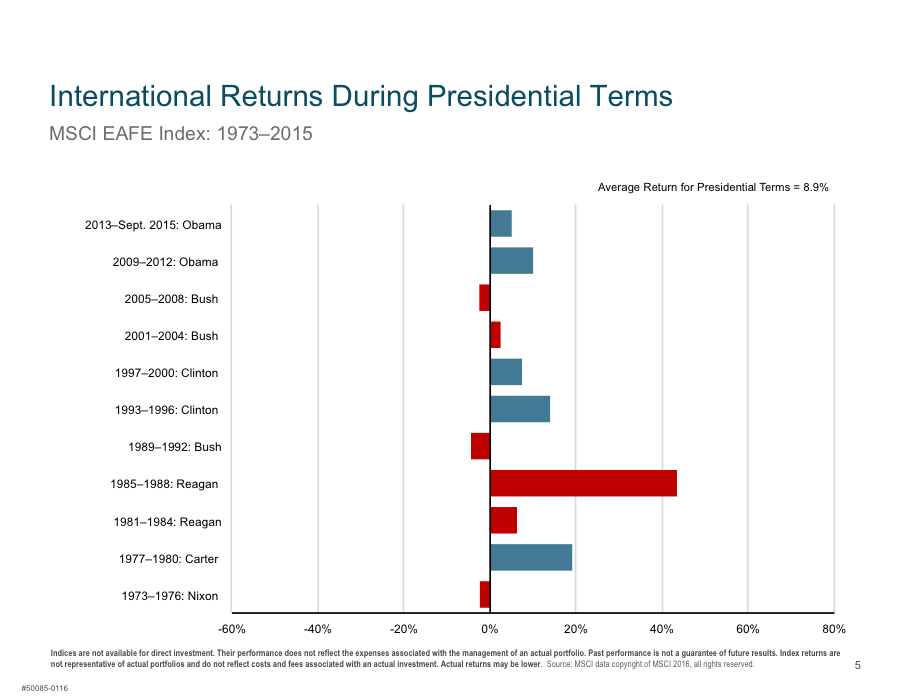

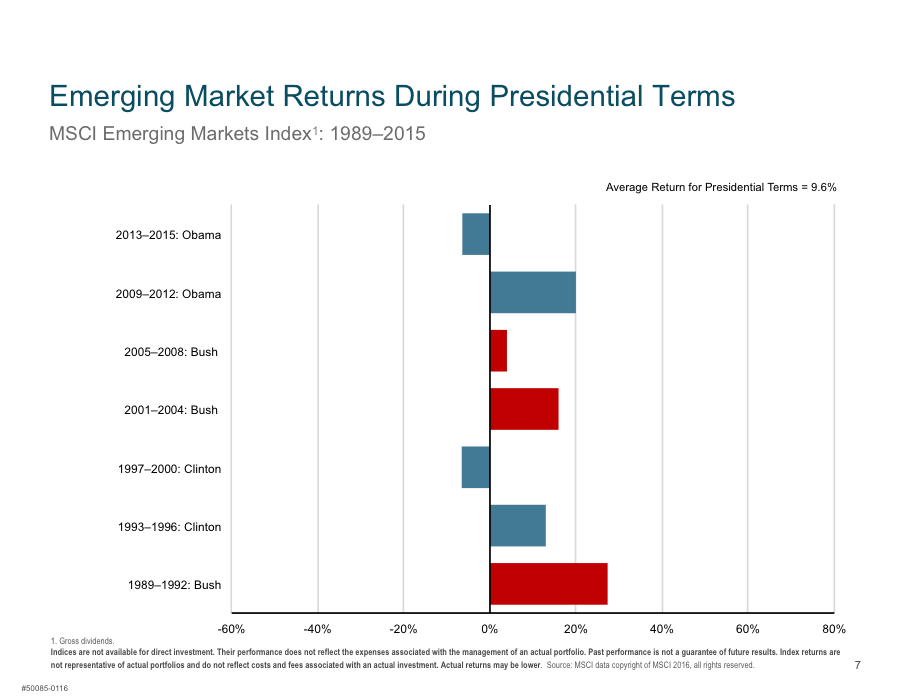

Let me share with you not just US returns, but also International, Emerging, and Bond returns. Why? Because when people try to time the market by going to cash until the world seems safe to them, it affects all parts of their portfolio.

Invest For Your Lifestyle

Real investing starts at retirement. We answer a simple question for clients: how do you outpace inflation while being able to get through volatile markets?

Well functioning markets are volatile. There are no portfolios that will go up in good or bad markets. You can have a portfolio that has long term growth over your retirement and enough cash to get you through the hard times. Why sell stock at the bottom when you can buy cheap and still have cash to fund your lifestyle?